Public-private hybrid under consideration.

from the Washington Post

The review by the nonprofit National Academy of Public Administration will analyze the benefits of restoring the agency’s financial health by using a “hybrid” model, which would farm out to the private sector postal operations other than the last delivery mile. A letter carrier would still drive or walk that last part, dropping letters and packages in mailboxes.

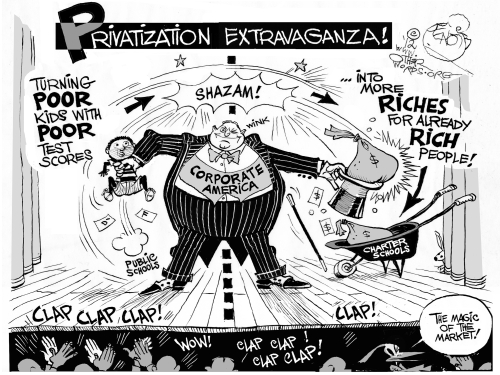

“Just as private companies innovate and share supply chains in high-tech, automobile, and other industries today, the market will drive efficiencies in the postal network,” a group of privatization advocates wrote in a short paper previewing the deeper review.

The study is likely to bring more attention to a public-private model as a viable — and controversial — substitute for the Postal Service’s existing structure, which relies on a unionized workforce of more than 650,000 employees to sort, package, transport and deliver the mail. With first-class mail volume plummeting as Americans conduct more business and communications through the Internet, the Postal Service lost $16 billion in fiscal 2012.

The idea of taking postal operations private is popular in conservative circles but will be a non-starter in others. It is staunchly opposed by congressional Democrats and postal unions, which stand to lose tens of thousands of members.

The Postal Service declined to comment on the study.

The House and Senate debated reforms over much of the last Congress, and a bill passed in the Senate in the spring. But lawmakers could not reach consensus on ending Saturday delivery and other service cuts, how much taxpayers should contribute to retirement benefits for postal employees and whether to tinker with their labor contracts, among other issues.

“Although the 112th Congress did not come to a consensus around a package of reforms that can update the Postal Service’s network and business model to reflect the reality that it faces today, we remain committed to working with our colleagues in both the House and the Senate to reform [the agency] so it can survive and thrive in the 21st century,” Sen Thomas R Carper (D-Del.) and Rep Darrell Issa (R-Calif.) said in a statement Thursday.

The lawmakers, respective chairmen of the Senate and House committees that oversee the agency, acknowledges that legislation in the Senate and House was far apart. But they described “significant progress in narrowing our differences in recent months.”

But advocates of the hybrid model say Congress would only be propping up a failing system.

“the trusted letter carrier would remain the public face of the US Postal Service,”

The study is being underwritten by Pitney Bowes, a Connecticut company that makes postage meters, shipping software and other equipment for business mailers.